Best Ways to Manage Financial Stress

Understanding the Importance of Budgeting

Creating a budget is more than just a financial tool; it's a roadmap to achieving your financial goals. By meticulously tracking income and expenses, you gain a clear understanding of where your money is going. This clarity allows you to identify areas where you can cut back, save more, and ultimately, build financial security. A well-defined budget empowers you to take control of your finances and move towards a more financially stable future.

Without a budget, it's easy to get caught in a cycle of overspending and debt. A budget provides a framework for making informed financial decisions, ensuring your spending aligns with your priorities and long-term goals. This proactive approach to managing finances is crucial for building a strong foundation of financial peace of mind.

Essential Steps for Creating a Realistic Budget

Developing a realistic budget involves more than just listing your income and expenses. It requires careful consideration of your lifestyle, spending habits, and financial aspirations. Start by accurately recording all sources of income, including salary, side hustles, and any other income streams. Then, meticulously categorize your expenses, distinguishing between needs and wants. This detailed breakdown helps you understand where your money is being allocated and identify potential areas for improvement.

Don't be afraid to adjust your budget as needed. Life circumstances change, and your budget should adapt accordingly. Regular review and adjustments are essential for maintaining a budget that remains relevant and effective in helping you achieve your financial goals.

Tracking Expenses Effectively: Tools and Techniques

Tracking expenses effectively is crucial for maintaining a successful budget. There are numerous tools available to streamline this process, from simple spreadsheets to dedicated budgeting apps. Choose a method that best suits your needs and preferences. The key is consistency; regular tracking ensures you have a clear picture of your spending habits.

Categorizing expenses into specific groups (housing, food, transportation, entertainment, etc.) helps you identify patterns and areas where you might be overspending. Reviewing your spending regularly, ideally weekly or monthly, allows for early intervention and adjustments to your budget as needed.

Identifying Areas for Savings and Cost Reduction

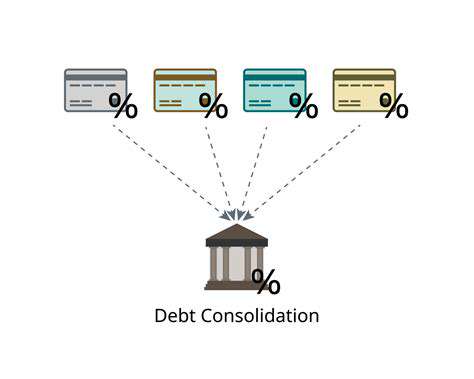

Once you've tracked your expenses, you can start identifying areas where you can save money and reduce costs. Look for recurring expenses that might be unnecessarily high. Consider negotiating bills, exploring cheaper alternatives for services, and finding ways to reduce your consumption of non-essential items.

Analyzing your spending habits allows you to pinpoint areas for potential savings. This could involve cutting back on dining out, reducing energy consumption, or finding more affordable alternatives for entertainment. Identifying these areas is crucial for building a solid savings plan and achieving your financial goals.

The Power of Automated Savings and Investments

Establishing automatic savings and investment plans is a powerful strategy for building wealth. Setting up automatic transfers from your checking account to a savings or investment account can help you save consistently without relying on willpower alone. This consistent saving is key to long-term financial success.

Investing your savings wisely can significantly boost your financial growth over time. Explore different investment options, such as stocks, bonds, or mutual funds, and seek professional advice if needed. Building a diversified investment portfolio can maximize your returns and help you achieve your financial aspirations.

Building a Sustainable Financial Plan

Budgeting and expense tracking should be ongoing processes, not just one-time tasks. A sustainable financial plan involves regularly reviewing your budget, making adjustments as needed, and celebrating your progress. It's important to remember that financial success is a journey, not a destination, and continuous improvement is key.

Staying motivated and disciplined is crucial for maintaining a long-term financial plan. Regular review of your progress, setting realistic goals, and celebrating milestones will help you stay committed to your financial objectives. This continuous effort ensures that your financial plan remains relevant and effective in helping you achieve your long-term goals.

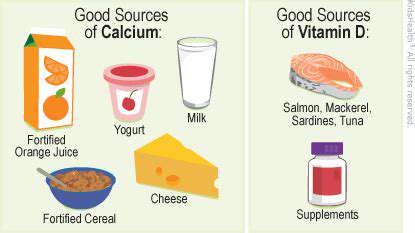

Traveling often exposes us to new environments, people, and potential pathogens. Strengthening your immune system before embarking on a journey is crucial for minimizing the risk of illness. A healthy diet rich in fruits and vegetables, packed with vitamins and antioxidants, provides the building blocks for a robust immune response. Consider incorporating foods like citrus fruits, berries, and leafy greens into your daily routine in the weeks leading up to your trip. These foods aren't just delicious; they actively support your body's natural defenses.

Read more about Best Ways to Manage Financial Stress

Hot Recommendations

-

*Guide to Managing Gout Through Diet

-

*Best Habits for Financial Well being

-

*How to Build a Routine for Better Mental Health

-

*How to Eat Healthy on a Budget [Tips & Meal Ideas]

-

*Guide to Practicing Self Acceptance

-

*How to Incorporate More Movement Into Your Day

-

*Guide to Managing Chronic Pain Naturally

-

*Guide to Building a Reading Habit for Well being

-

*Top 5 Weight Loss Supplements That Actually Work

-

*Best Exercises for Postpartum Recovery [Beyond Abdominal Work]